tax shield formula excel

Do the calculation of Tax Shield enjoyed by the company. This gives you 750 in depreciation for the first six months of ownership.

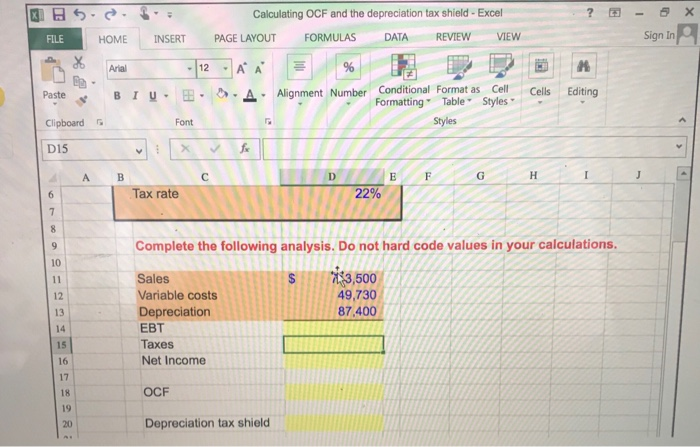

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

In the line for the initial cost.

. Based on the given information the WACC is 376 which is comfortably lower than the investment return of 55. For example suppose you can depreciate the 30000 backhoe by 1500 a year for 20 years. 10000 Add to Cart.

WACC 0583 45 0417 40 1 -32 WACC 376. And now you can get the sales tax easily. Case 1 Taxable Income with Depreciation Expense TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses x tax rate or EBT x tax rate.

Energy Industry Comps Template. So with the use of one of the six sigma tool we can find out the chances of defects in the product and we try to rectify it by using all resources properly. .

Calculate sales tax if you get tax-inclusive price. How to calculate tax shield due to depreciation. These two equations are essentially the same.

The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. Actually you can apply the SUMPRODUCT function to quickly figure out the income tax for a certain income in ExcelPlease do as follows. 6In row 20 and row 30 the cash flow from depreciation is just the tax rate multiplied by depreciation for that year.

How to calculate NPV. Interest Tax Shield Interest Expense Deduction x Effective Tax Rate Interest Tax Shield 4m x 21 840k. As such the shield is 8000000 x 10 x 35 280000.

This is equivalent to the 800000 interest expense multiplied by 35. The effect of a tax shield can be determined using a formula. In some regions the tax is included in the price.

Tax Rate and Tax Shield. Tax Rate 40Tax Shield Sum of Tax Deductible Expenses Tax rate. In the condition you can figure out the sales tax as follows.

Tax Shield Deduction x Tax Rate. This energy industry comps template provides a guideline and example of what a comparables universe would look like for a. The tax shield formula is simple.

Sum of Tax Deductible Expenses 10000. 1-046 24 1-046 25 of between 24 and 25 pre-tax. Use absolute reference on the tax rate before copying 7Calculate the Net Salvage Value for each case.

Multiply your tax rate by the deductible expense to calculate the size of your tax shield. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. CF CI CO CI CO D t.

In this video on Tax Shield we are going to learn what is tax shield. For more resources check out our business templates library to download numerous free Excel modeling PowerPoint presentation and Word document templates. This is usually the deduction multiplied by the tax rate.

NSVMV-T x MV-BV Here the book value BV for straight-line will. The following is the Sum of Tax-deductible Expenses Therefore the calculation of Tax Shield is as follows Tax Shield Formula 10000 18000 2000 40. Hence it is a good idea to raise the money and invest.

This reduces the tax it needs to pay by 280000. Tax Shield 10000 40 100 Tax Shield 4000. PV of Tax Shield.

Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. We also provide a downloadable excel template. Where CF is the after-tax operating cash flow CI is the pre-tax cash inflow CO is pre-tax cash outflow t is the tax rate and D is the depreciation expense.

The PV of the interest tax shield can be calculated by discounting the annual tax savings at the pre-tax cost of debt which we are. Calculate the present value PV of each interest tax shield amount by dividing the tax shield value by 1 cost of debt period number. Based on the information do the calculation of the tax shield enjoyed by the company.

Recall the NSV formula is as follows. Multiply the interest expense by the tax rate assumptions to calculate the tax shield. 1In the tax table right click the first data row and select Insert from the context menu to add a blank rowSee screenshot.

Select the cell you will place the sales tax at enter the formula E4-E4 1E2 E4 is the tax-inclusive price and E2 is the tax rate into it and press the Enter key. The expression CI CO D in the first equation represents the taxable income which when. .

How to calculate after tax salvage valueCORRECTION. By Corporate Finance Institute. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable.

Tax shield Pre-tax Income adjd Tax rate Net Income Net Cash Flow PV of Net Income Discount rate Total NPV of Income Pre-tax Note. Tax shield formula excel Monday February 28 2022 Edit. 2Select the cell you will place the calculated result at enter the formula SUMPRODUCTC6C12-C5C11C1.

Tax Shield Formula Step By Step Calculation With Examples

Net Operating Profit After Tax Nopat Formula And Excel Calculator

Interest Tax Shield Formula And Excel Calculator

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Effective Tax Rate Formula Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

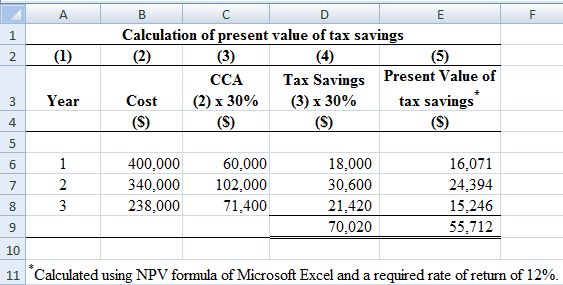

Chapter Mcgraw Hill Ryerson C 2013 Mcgraw Hill Ryerson Limited Making Capital Investment Decisions Prepared By Anne Inglis Ppt Download

Chapter 13b Solutions Managerial Accounting Tenth Canadian Edition 10th Edition Chegg Com

Unlevered Free Cash Flow Definition Examples Formula

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Solved Calculating Ocf And The Depreciation Tax Shield Excel Chegg Com

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples