oregon 529 tax deduction 2019 deadline

Oregon 529 tax deduction 2020 deadline. 100 units will always equal one year of tuition.

529 Plan Advertisements And Marketing Collateral

Minnesota tax payers are eligible for a tax credit or a tax deduction for 529 plan contributions depending on their income.

. Families can deduct up to 4865 worth of these contributions from their state tax. Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers. Oregon Department of Revenue 17651901010000 2019 Schedule OR-529 Oregon College Savings Plan Direct Deposit for Personal Income Tax Filers Submit original formdo not submit.

Tax deduction procedures for 529 tactics. State income tax deadlines are approaching but families saving for college may still have time to reduce their 2021 taxable income. Every year the GET program determines the price of a unit.

If you currently take advantage of this option you are able to carry forward. Currently over 30 states including the. This income tax funds public transportation services and improvements within Oregon.

The tax is equal to one-tenth of 1 percent 01 or 0001 of the wages received by an. At the end of 2019 I contributed 24325 to carry forward. State tax benefit.

The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019. The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019. Rollover contributions up to.

Unlike prior years these carry forward. I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program. You may carry forward the balance over the following four years for contributions made before the end of 2019.

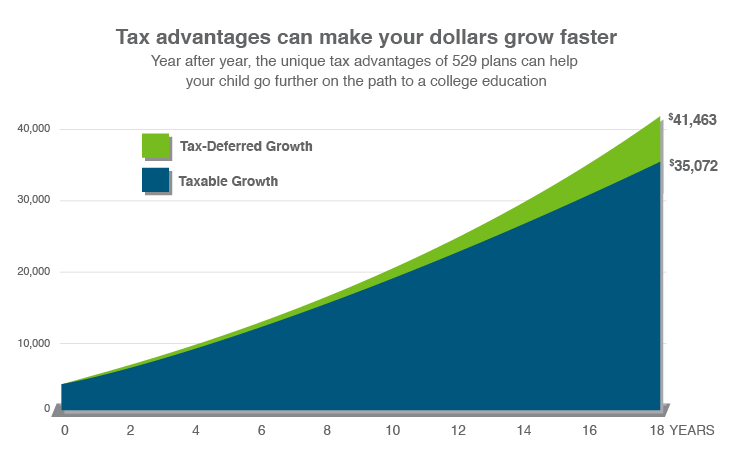

Oregon 529 Plan And College Savings Options. The maximum amount to contribute to qualify for both the deduction and the credit is 24325 for those filing jointly or 12175 for individuals. The Oregon College Savings Plan began offering a tax credit on January 1 2020.

If you currently take advantage of this option you are able to carry forward. For example if a couple contributed 15000 to their sons Oregon College Savings Plan account in 2019 they may subtract a maximum of 4865 because.

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Dreamahead Faqs Washington College Savings Plans

529 Plan Impacts For Tuition Refunds H R Block

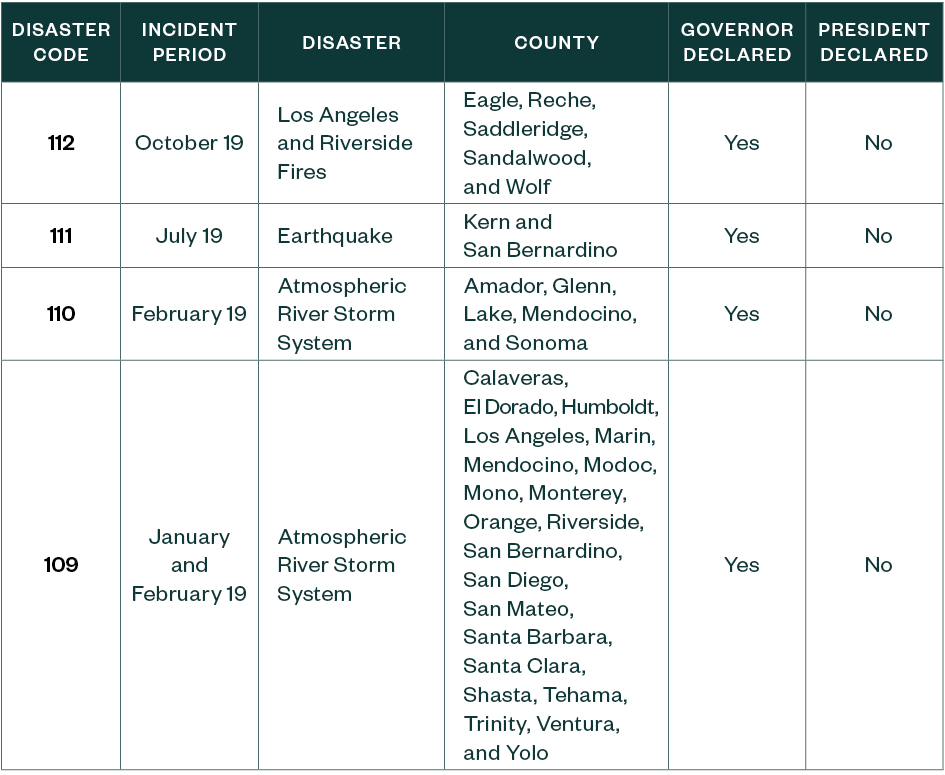

Tax Season 2020 California Businesses And Individuals

Officials Say New Mexico S 529 College Savings Plan Underused Business Santafenewmexican Com

States Where You Can Claim A Prior Year 529 Plan Tax Deduction

Information On 529 Plans Turbotax Tax Tips Videos

What Is The Salt Tax Deduction Forbes Advisor

529 Plan Advertisements And Marketing Collateral

Oregon Kicker Rebate Of 1 4 Billion Tax Revenues Up 1 Billion In Stunning Forecast Oregonlive Com

529 College Savings Plans For Your Future Student Bright Start

529 Plan Advertisements And Marketing Collateral

/GettyImages-936317872-35f1a1c79a9a4545ad7f71f05707338b.jpg)

529 Plan Contribution Limits In 2022

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

Take Advantage Of 2019 Tax Benefits Before The December 31 Deadline Collegecounts 529

Tax Benefits Oregon College Savings Plan

Oregon State Tax Software Preparation And E File On Freetaxusa